|

| Home > Policy Issues > Smart Growth Tax Credit > Introduction | |

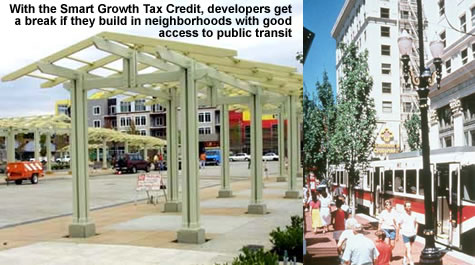

IntroductionThe Smart Growth Tax Credit Act is a prime example of how states can save money while making their cities cleaner and greener. The proposed tax credit is designed to give developers a break for building in more densely-populated areas and for complying with cutting-edge green building standards. Such a law could save your state billions of dollars in the long run while encouraging the production of smarter, more sustainable development, conserving undeveloped land, reducing air and water pollution, improving public health, reducing traffic congestion, ensuring more efficient water usage that will help prevent future drought emergencies, and reducing energy bills and transportation costs for residents. |

|

|

|

In this policy issues package, we give you the tools and resources necessary to adapt the legislation so it works with the level of planning that exists in your state. These tools include a sample bill, frequently asked questions, talking points, press clips, a fact pack, research, and other background information. We may have other useful materials on this subject which are not posted on our web site. Please feel free to contact us at [email protected] or call our office in Madison, Wisconsin, at (608) 252-9800. Specific questions about any provision of the legislation should be directed to Deron Lovaas at Natural Resources Defense Council’s Smart Growth and Transportation Program (202-289-6868). See also our Suburban Sprawl, Community Revitalization, and Green Building policy issues packages for further information. If you’ve used this site and found it helpful, or if you have suggestions about how it could be made more helpful, please let us know. |

|

| This package was last updated on September 27, 2004. |